There has been a renewed interest and investment in the autonomous marketplace. As an ecosystem, it has matured, and investors have a clearer sight of the winners to back. This is also being helped by increased collaboration and consolidation between the key operators. This has ranged this year from Toyota working with Aurora Partners on self-driving Sienna taxi is to Waymo and Daimler teaming up to build fully driverless trucks. And let’s not forget the ongoing press around who Apple is approaching to work with them!

So, passenger applications have had a renewed interest – with Alphabet backed Waymo leading the investment charge in this space. The pandemic has also put renewed focus and investment into the use in the logistics industry – in the

‘last mile’ and ‘middle mile’ in particular.

The Trucks:

Last Mile: Nuro – a robotics company – develops and operates a fleet of self-driving vehicles that deliver everything from your dinner to your dry cleaning, quickly, affordably, and safely.

Middle Mile: Short-haul autonomous driving company Gatik is one of the only self-driving logistics companies focused on what it calls the “middle mile,” which connects warehouses and micro-fulfillment centres with stores and distribution centres. Many believe the “middle mile” is easier to automate because the routes are fixed, making the go-to-market time faster.

Big miles: Investors seem to have warmed again to this part of the journey, with brands such as TuSimple and Inceptio Technology developing self-driving trucks to enable large-scale commercialization of autonomous transport and have pulled in $500m+ in funding recently.

The Sensors at the heart of AV

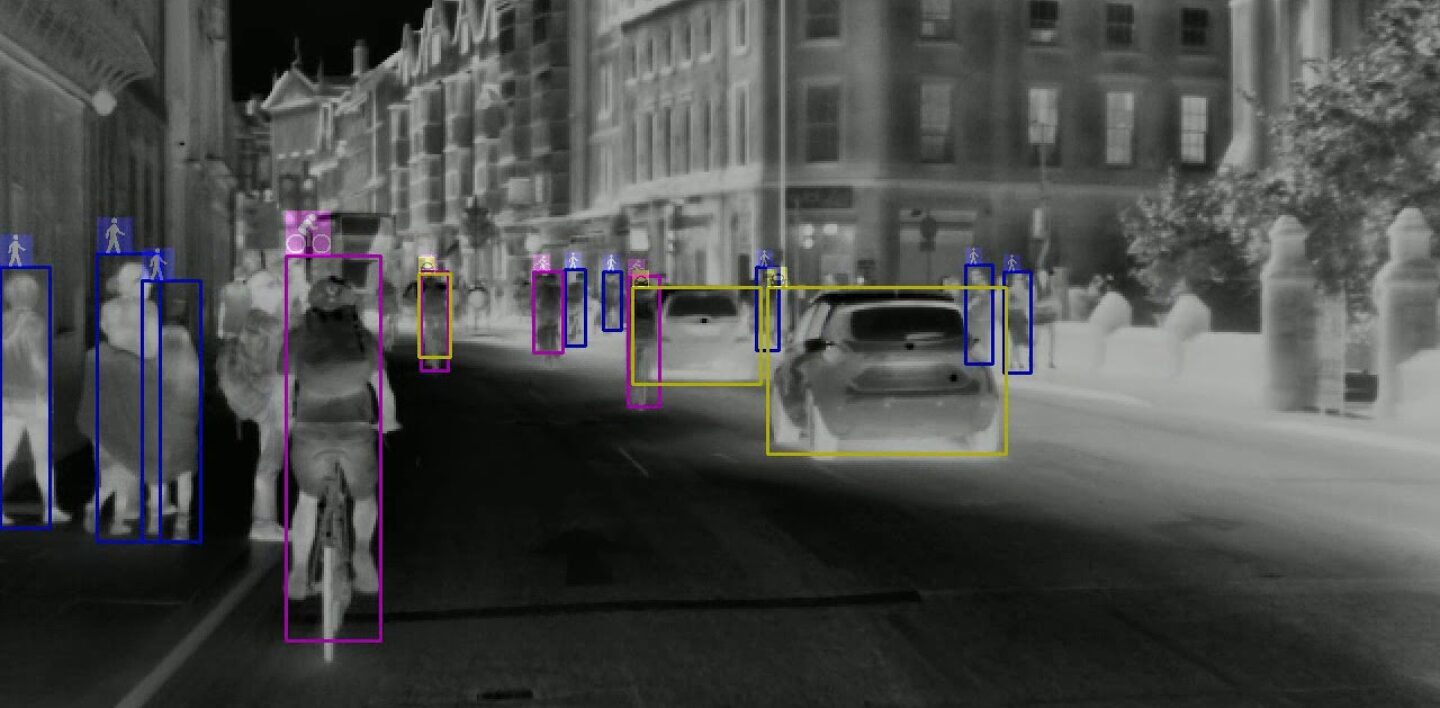

There is a wide variety of sensors utilised on AV – from Lidar to Radar to Thermal. A vital part of the system. A smart thermal sensor has been developed called AdaSky – the VIPER. It enables an autonomous vehicle to sense and analyse its surroundings in any lighting or weather condition.

The Training of the AI

That’s right, even the AI needs training. It segments into 3 core areas.

So the autonomous technology scene is certainly one to keep one eye on particularly when linked to statements from the likes of Elon Musk, where he believes that the impact of autonomous technology will transform the cost of EV ownership from being a depreciating asset on your domestic P&L to one that can make you money while you sleep – that’s right – send your EV out to work for you while you are not using it. This of course then throws up a lot of questions around the support for such use of your asset. Maybe the future will be that Lyft or Uber are subletting your vehicle for the downtimes, and whilst in their use receives the service/valet at the end of the ‘shift’.

All of this will certainly change the cost of ownership model, plus create new accessibility options to the technology and cars.

Perhaps in the future, your car will be a joint ownership model with Lyft or Uber…

To find out more about our capabilities and expertise around the implementation of EV services and design for their needs, please do contact us.